Introduction

The impact of Pandemic has been felt across the globe and has had a significant effect on different domains and Information Technology. Mergers and Acquisitions (M&A) is the quick solution to meet the changing business models, better customer experience and Time to Market.

In addition, some of the organizations across the globe have shut down their operations because of a loss of their customer base or less demand for their business because of the Pandemic situation. This resulted in an opportunity for the acquisition of distressed organizations.

According to Gartner, the “M&A bonanza is expected to peak in 2022, with more highs than seen in 2018”.

According to PwC’s global M&A industry trends, digital transformation remains a priority for many organizations. Technology to support remote working, online education, ecommerce and entertainment has become the need of the hour and this increases the demand and competition to acquire the necessary business infrastructure, and forces premium valuations.

The success of merging of two organizations relies on multiple factors like, economic certainties, accurate valuations, proper identification of targets, strong due diligence processes and technology integration. However, the prominent factor among all these is technology integration i.e. merging their IT systems.

The IT systems of each organization consists of a set of applications, IT infrastructure, databases, licenses, technologies and their complexities. After integration, one set of systems and their infrastructure becomes redundant. Greater the amount of duplication, higher is the redundancy leading to an increase in costs and complexity of an integration.

The role of CIO and Information Technology (IT) in M&A has become increasingly important, as the need for quick turnaround time is the primary factor.

The CIO’s need to be involved during the deal preparation, assessment, and due diligence phase of M&A. In addition, the CIO’s team needs to identify key IT processes, IT risks, costs and synergies of the organization.

According to Mckinsey, “Many mergers don’t live up to expectations because they stumble on the integration of technology and operations. However, a well-planned strategy for IT integration can help mergers succeed”.

As part of the IT integration activities the CIO team should cover,

- Creation of IT integration roadmap

- Identification of cross functional dependencies and ownership

- Defining key IT deliverables

- IT transition plans

- Application portfolio rationalization, consolidation strategy

- Decommission strategies for retired systems

- Identify the applications that helps in business as usual

CIO Involvement

CIOs need to be involved at very early stages of the M&A deal and must be part of deal finalization team. They eed to participate in discussions with various organizations to decide on the right fit for the M&A goal of the target organization. The CIO team evaluates the merging organization before deciding on the valuation of the organization.

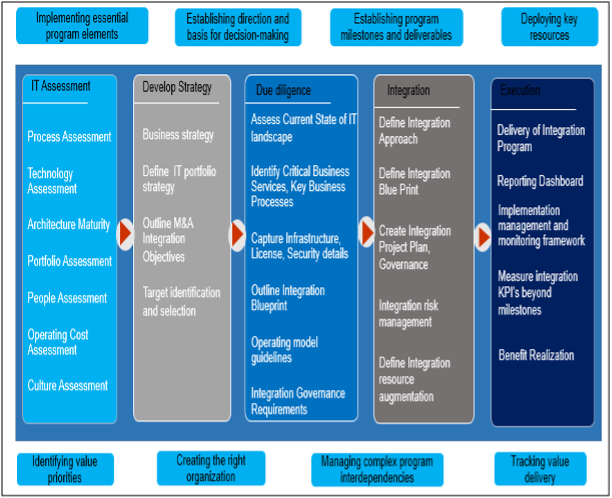

Once decided to go with the deal the CIO and IT team need to get involved in various phases of the M&A activity that covers assessment, strategy, due diligence, integration and execution.

The following sections highlight the involvement of CIO in each phase and the role of IT in brief.

Assessment Phase

During the assessment phase, the CIO evaluates the target organization from the IT perspective, highlight the IT related synergies and risks. The inputs provided by the CIO helps to evaluate the target organization. The assessment covers the following aspects:

- Process Assessment

- Technology Assessment

- Architecture Maturity

- Portfolio Assessment

- People Assessment

- Operating Cost Assessment

- Culture Assessment

This helps the CIO and IT team to plan and prepare for the level of system complexity, while integrating the two organizations.

If a CIO is not aware of the deal’s business intent, it may result in confusion, delays, and loss in time.

Strategy Phase

CIOs need to study the organization’s broad strategic goals, the existing business locally and globally as well as identify value-creating opportunities and verify the regulatory policies.

During this phase, the CIO team develops M&A principles and templates for the due diligence and planning phase. IT portfolio strategy is developed, which is in alignment with organization’s business goals. The strategy phase covers:

- Business strategy

- Define IT portfolio strategy

- Outline M&A Integration Objectives

- Target identification and selection

Due diligence Phase

The CIO and IT leadership team need to identify the target organization’s current IT people, processes, technology, applications, infrastructure and IT services portfolio. They also need to assess and evaluate target entity’s components with the acquirer’s existing processes, applications and platforms, as well as estimate, how much compatibility is there between IT architectures and assets of the merging organizations.

The team needs to prepare the high-level integration plan that covers the cost, timeliness, requirements and priorities as well as prepare the estimates of expected costs and anticipated benefits, resources and timeframes required to address risks and issues. The Due diligence phase covers:

- Assess Current State of IT landscape

- Identify Critical Business Services, Key Business Processes

- Capture Infrastructure, License, Security details

- Outline Integration Blueprint

- Operating model guidelines

- Identify Integration governance requirements

- Identify the related risks

Integration Phase

The CIO needs to form an IT integration team during this phase that understands the acquired organization’s IT systems and structure and development of overall integration strategy, blueprint definition and target operating models done during this phase. The Blueprint covers the integration strategy, approach and design principles, integration requirements and opportunities in specific business and functional areas addressed. As well as detailed project plan for all participating business and/or functional areas defined during this phase. The design phase covers the following activities:

- Define Integration Approach

- Define Integration Blueprint

- Define Integration Governance

- Create Integration Project Plan

- Integration risk management

- Define Integration resource augmentation

Execution Phase

Preparation of detailed integration plan covering milestones and priorities done during this phase is important. The CIO must ensure the IT team to focus on completing critical IT work and not to distract by non-critical IT work. The CIO needs to focus on data migration, system integration, vendor consolidation activities during this phase. This phase covers:

- Delivery of Integration Program

- Reporting Dashboard

- Implementation management and monitoring framework

- Measure integration KPI’s beyond milestones

- Benefit Realization

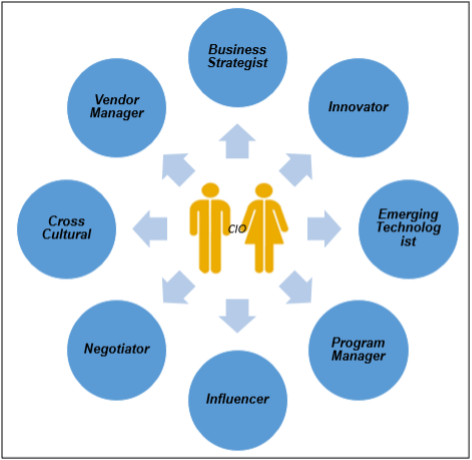

Capabilities of CIO & IT Team

The CIO’s role is very critical in M&A and shall get involved from the beginning of the deal. The CIO is one of the critical members of the deal finalization and decide on the “Go or No-Go” of the merger deal. The following diagram depicts the capabilities of the CIO:

The following are the broad capabilities that CIO shall possess in M&A integration activities:

- Business strategist, able to understand the business strategy, capabilities of both the organizations

- Innovative thinking, driving innovation in businesses and aligning IT strategy to support business initiatives. CIO must have the capability to involve in product selection, product integration in broader Organization landscape and guiding projects across the Organization

- Emerging Technologist, thorough understanding of current technology (applications infrastructure and processes). Need to have the deep technology expertise and is aware of developments and innovations with focus area of participating in industry/vendor standards bodies/consortia and help driving innovation and adoption that helps to drive the business strategy

- Program Manager Skills, have strong program management capabilities to achieve a M&A integration within the desired costs and time-frame, and achieve desired synergies.

- Influencer, robust understanding of the business and cross functional areas along with high level organization decision making skills to take key IT decisions that directly influence the deal

- Negotiator, to influence key deal decisions from the pre-deal stages

- Cross Cultural Skills, must possess strong people and cross cultural skills to deal with cultural and people integration issues and motivate staff members during M&A integration

- Vendor Management Skills must have strong vendor relationship skills to leverage the IT outsourcing partner for integration, minimize risks, maximize flexibility and derive value out of any merger or acquisition.

Best Practices of M&A Integration Strategy

To maximize value of M&A, CIOs need to promote transparency in business capabilities, identify IT integration risks, communicate IT integration progress and capture feedback and build trust of executives and team. Some of the best practices to follow are:

- Involve IT early, pre-merger stage itself

- Align IT strategy with business strategy of the organization, which helps in defining the integration approach

- Conduct due diligence before the merger is closed

- Deploy ready-made IT tools, templates and checklists for quick output

- Effective communication, Clear communication of objectives of IT integration of M&A to respective stakeholders

- Integrate in iterative way to see the quick results

- decide on Build Vs buy

- Best application selection to reduce IT integration complexity

Acknowledgements

The author would like to thank Vijayasimha Alilughatta & Raju Alluri of Wipro Digital Architecture Practice of Wipro Ltd for giving the required time and support in many ways in bringing up this article.

Dr. Gopala Krishna Behara is a Lead Enterprise Architect in Wipro Digital Architecture Practice division of Wipro. He has a total of 25 years of IT experience. He can be reached at gopalkrishna.behra@wipro.com.

Public Profile: https://www.linkedin.com/in/gopalbehara/

Disclaimer

The views expressed in this article/presentation are that of authors and Wipro does not subscribe to the substance, veracity or truthfulness of the said opinion.