By Siddesh Mahadik

The Business Capability Model (BCM), is the cornerstone of the Business Architecture discipline, and is amongst the most important models/maps (if not the most important) in this practice. However, having just the BCM alone has limited value. The BCM becomes potent if it is embedded in the strategic, planning and operational processes of an institution, and is used to derive insights and guide decision making.

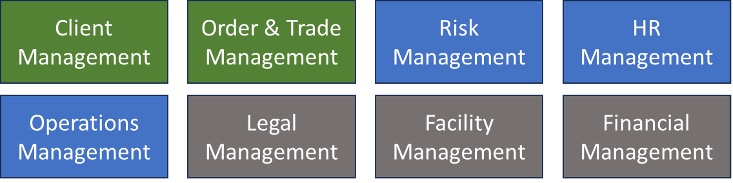

The goal of this article is to showcase few indicative examples of using the BCM to generate such insights. For the sake of simplicity, only 8 Level 1 Business Capabilities are considered in the financial services use cases below. In practice, these maps will often extend to multiple L2 and L3 capabilities.

- Business Capability Disposition

In this analysis, the business capabilities are tagged into 3 buckets:

Basic (B) – capabilities that organization needs to have to function, but there is no inherent advantage is getting relatively better when compared to our peers/competition. These capabilities are often considered for managed utility /services arrangements. In certain instances, even sub-par capabilities when compared to competition/peer will suffice

Competitive (C) – capabilities need to be at par with competition/peers, and will impact the firm if they are subpar when compared to peers. However, there is limited upside in having these capabilities significantly better than peer/competition

Differentiation (D) – capabilities need to be superior compared to competition/peers, and this relatively differentiation will often result in higher market share or increased revenue

This overlay will be used during the strategy phase, and is derived from conversations with management and senior stakeholders. This view brings everyone to the same page in terms of setting organizational priorities. It is good to visit the BCD tagging as part of the annual strategy refresh cycles, and ideally should not change often. However, if there is a change in Business Priorities, then these categorizations should be updated accordingly. The focus at this stage is on “how important is this capability” and NOT “how do I compare the capability to others.”

Executives can discuss the disposition of the various capabilities that impact their portfolio, and can tag them into B vs. C vs. D. There may be multiple executives who may disagree the actual categorization, and it may be necessary to take an aggregate or threshold view in these scenario (8 out 10 stakeholders say capability is basic, and hence the capability is tagged as basic) or separate views can be maintained as needed. Below is one such example

Color Coding: Green – Differentiation, Blue – Competitive, Grey – Basic

Insights Generated

In this hypothetical example, based on multiple stakeholder discussions, capabilities were tagged after summarizing executive conversations

- Client management, or order/trade management are tagged as differentiation capabilities. Onboarding a client quicker/ offering a 360 view to cross sell products, or cutting down latency/price in trading system will often result in client delight, and higher revenues or market share and are hence tagged differentiating.

- Having a market leading, or competitive Financial Management system (Show Profit & Loss/ Revenue statement) will not yield substantial benefits, and could be serviced by an industry utility (like Peoplesoft).

- Operations Management (post trade functions) is tagged as competitive, since servicing the client orders needs to be at par with competition. However, if the financial organization decides to enter the Clearing or Custody business, this capability will change to “Differentiating” as this becomes a significant driver to gain revenues and market share

- Basic capabilities can be delivered through industry utilities or managed service/ outsourcing agreements as they are relatively low priority, however, the differentiating capabilities should ideally have the best staffing and technology focus to leap frog the competition

- Gap/ Pain Point Mapping

The business capabilities can be heat mapped with “Gaps” or “Pain Points” based on discussions with stakeholders. There is often an element of subjectivity associated with this exercise, which can be mitigated by some quantitative factors to determine the thresholds (for e.g., 10+ audit points are high, <10 is medium, 5-10 is low)

One bolt indicates low-medium number of gaps / pain points

Two bolts indicates high-very high number of gaps / pain points

Insights Generated

This hypothetical view indicates Order & Trade, Legal and Financial Management capabilities have some gaps/pain points associated, but the operations management has the highest number of issues. Deeper investigations could reveal that this is primarily due to Operational Reconciliation Management capability which is subpar and resulting in lot of manual issues. Once this is identified, several options could be considered to resolve this which could include:

- Fixing data at source system resulting in no / fewer reconciliation

- Investing in a robotics or automation tools

- Keeping the process manual but moving it to a lower cost region

- Outsourcing this capability as a managed service

- Technical Differentiation

Furthermore, the capabilities can be tagged along the lens of “technical BCD” as well. This means that a superior technology solution will make this business capability better. In below example, 3 capabilities are deemed as technically differentiating, and hence tagged in red square icons

Insights

- Having a differentiating technology solution may have little to no impact for a facility / building management business capability, and hence investment dollars are perhaps better spent towards non-IT initiatives including aesthetic environments, comfortable furniture and an experienced support staff.

- However, this may not be true for an Order Management capability, in which superior algos trading systems shaving off milliseconds on high volume activity can result in significant revenue/profits

- However, the same business capability may be differently tagged for another business – order/trade management is technically differentiating for an Algo execution business, but it may not have the same disposition for a wealth management business. For this business, having the next generation trading platform with sub milli second latency may not be as important, and it is perhaps better to invest the limited funds into acquiring customers via marketing tools or increasing quantity/quality of relationship manager to reach out directly to existing/news customers

- Spend Prioritization

Every organization has limited funds and needs to prioritize projects/programs that offer the highest impact. One way to do this to use (a combination of) above analysis to assess maximum impact. Below map has the overlay of all 3 categories mentioned above.

Insights

- Based on this, one can prioritize technology programs/projects mapped to Order & Trade management capabilities. This capability is

- Differentiating and hence important to business strategically

- Technically differentiating – improving technology will improve business via increased revenue, profits, market share

- Has multiple pain points / gaps assessed, which can be reduced/eliminated via these program and projects

- Programs geared towards Operations Management can be prioritized next, and then Legal and Financial Management

This may be further augmented by quantitative Return of Investment (RoI) Analysis to force rank and prioritize programs/projects across the portfolio

- Application Rationalization

If the application portfolio is mapped to the BCM, it often can give insights for Application rationalization activity. This is true for large corporations with thousands or tens of thousands of applications across their overall portfolio. Below view has all applications mapped to the business capability

Insights

Some insights or commentary that could be triggered based on this view may include:

- Order and Trade Management has 67 legacy apps out of 87, and is an ideal candidate to start application rationalization activity. The CIO can initiate a program to reduce the application footprint and move over the strategic application portfolio

- Often, the strategic applications will be likely candidates to be evaluated when the legacy application are retired. This allows the overall count to not increase further, and the existing strategic applications may be considered for adoption

- Program Alignment

Business Capabilities can be mapped to investment spend, both change and run/maintain to derive insights. As part of the planning process, PMO can mandate mapping of new Book of Work programs/projects to the business capabilities, at L1 and L2, to aggregate investment metrics. These metrics/dashboards should force executives/ program and capability sponsors to rethink some of their priorities and reconfirm or readjust the programs as needed.

Here “Change Spend” indicates change funds to improve, overhaul or decom applications / infrastructure, whereas “Run Spend” indicates funds to keep the applications/processes just up and running

Insights

If above view is generated based on mapping program spend to L1 business capabilities for the next annual investment cycle review, some insights or commentary that could be triggered may include:

- 99M is focused on change programs for Order and Trade management capability. This is relatively large, but could be appropriate if there is a large program/portfolio of programs to either rationalize or modernize this portfolio. Also, once the change program is completed, the overall spend on this capability should go down significantly, whilst significantly improving the technical differentiation maturity of this critical business capability (bleeding edge, market leading solution resulting in additional revenue or market share)

- HR management is relatively mature, with not much change or run/maintain investments

- Facility management is also relatively mature, the facilities/building portfolio is good enough and there are no medium-large scale programs planned to change the footprint

- Operations management has large Run costs. While this could be deemed ok after investigations, but perhaps there is an opportunity to reduce this drastically by potentially investing in certain change initiatives like application rationalization or infrastructure consolidation, bringing the run costs down significantly

- Bench Marking

If the same reference business capability map is leveraged across the industry/domains, it becomes exponentially useful and serves as the basis for relative comparison and benchmarking. It serves as a robust starting point for executives and decision makers. Some of the Insights generated could include:

- Compare investment spends on same capabilities across industries and understand averages and deviation. If there is significant variance, corrective action could be undertaken as needed (certain important capability is under invested when compared to peers)

- Corporate transactions like Mergers, Acquisitions, Divestitures can use the BCM has the starting point to initiate discussions and generate roadmaps. For example, if both organizations have a common BCM reference model, it can be leveraged to compare application portfolio and decide target app portfolio (one org has strategic apps mapped to BCM, whereas other has legacy)

- Technology consulting firms (e.g., Gartner, Forrester) can use the model to publish comparative research within/across industries, if they all refer to a common model. These reports usually parse through large volume of data, and a common semantic model helps do an accurate “apples-to-apples” comparison

Conclusion

As one can deduce, there are multiple use cases in how the Business Capability Model can be deployed within the organization to generate tangible insights for the executive decision makers at medium to large sized corporations. A well-defined model that is integrated into the firm’s governance processes and tools will substantially accelerate this insight process. However, this should only serve as a starting reference point and it is vital that the organization encourages the next level of deep dives to validate or reject these hypotheses. The intent of this paper was to demonstrate the “art of the possible” by showcasing these few basic hypothetical examples or use cases. It is recommended that these be considered as “tools” within your toolkit to facilitate these discussions. One should ensure that proper dialogue is encouraged, frameworks are discussed, tweaked as needed and not simply forced them onto the organization as a rigorous, authoritative set of methodologies and processes to generate such insights.

About Author/ Notes

Siddesh currently leads the Employee Conduct Technology organization within Compliance at Credit Suisse and is based out of NY. Prior to this role, he led the US Business Architecture function at Credit Suisse as part of the Group Strategy & Architecture organization, leading multiple complex high impact engagements for senior technology and business executives. He holds a Bachelors of Computer Engineering from Mumbai University and Masters in Information Systems from Carnegie Mellon. The views represented in the article was held by the author alone, and may not represent the views/opinions of his employer

role, he led the US Business Architecture function at Credit Suisse as part of the Group Strategy & Architecture organization, leading multiple complex high impact engagements for senior technology and business executives. He holds a Bachelors of Computer Engineering from Mumbai University and Masters in Information Systems from Carnegie Mellon. The views represented in the article was held by the author alone, and may not represent the views/opinions of his employer